10 Feb Detailed MM2H Application & Requirements for You! (Latest 2026 Updates)

You have likely searched “Latest MM2H requirements” multiple times, only to find conflicting answers. One source says Silver is five years, another says ten. Is property purchase mandatory or optional? Minimum age 21, 25, or 35? This confusion is common, and the wrong assumption can cost months of delays—or even a visa rejection.

Between 2024 and 2026, repeated policy changes reshaped the Malaysia My Second Home (MM2H) programme into a tiered system, including the recently introduced SFZ option.

Online information has not kept pace, and important details, such as the 12-month property purchase deadline, are often buried, while incomplete applications frequently trigger delays of 3 to 6 months.

This article serves as a project management guide for efficiently executing your MM2H application, providing a roadmap with clear timelines, required documents, and decision points at every stage.

Moore Bzi guides you through every policy change, helping you avoid costly mistakes and ensuring a smooth, confident MM2H application.

What this article covers:

- Quick tier selection based on real application requirements

- Mandatory property purchase rules

- Document checklist, including special family situations

- Step-by-step MM2H application, endorsement, and property process

- How to vet an MM2H agent

The New 2026 MM2H Tiers: Which One Fits Your Budget?

The latest MM2H programme introduces a tiered system including Silver, Gold, Platinum, and the Special Economic/Financial Zone (SEZ/SFZ) option. Each tier has different financial thresholds, property obligations, and age requirements.

Tier Comparison Table

| Tier | Fixed Deposit (USD) | Property Minimum (RM) | Purchase Deadline | Age Requirement | Best For |

| Silver | 150,000 | 600,000 | 12 months | 25 years and above | First-time applicants ready for fast decisions |

| Gold | 500,000 | 1 million | 12 months | 25 years and above | Families needing financial breathing room |

| Platinum | 1 million | 2 million | 12 months | 25 years and above | Ultra-High-Net-Worth (UHNW) applicants seeking maximum cash flow flexibility |

| SEZ/SFZ | Tier-based | Tier-based | 90-day (fast-track) | 21 years and above | Applicants in SEZ requiring expedited purchase |

Not sure which MM2H tier fits your budget and timeline? Our relocation guide breaks down tier benefits, visa durations, property rules, and lifestyle considerations to help you choose the right option for your family.

Understanding Mandatory Property Purchase

Under the 2026 MM2H programme, property purchase is mandatory for all tiers—a key change from the previous optional structure. You have within 12 months of visa endorsement (3 months for SEZ tier) to complete your purchase.

This deadline is strictly enforced. Missing it may result in visa cancellation with no automatic extensions.

Property Planning Strategy

Strategic Fixed Deposit Withdrawal

You can withdraw up to 50% of your fixed deposit (FD) to fund the property purchase:

| Tier | FD Amount (USD) | Withrawal Limit (USD) |

| Silver | 150,000 | 75,000 |

| Gold | 500,000 | 250,000 |

| Platinum | 1 million | 500,000 |

| SEZ/SFZ (21-49 years) | Tier-based | 65,000 |

| SEZ/SFZ (50 years & above) | Tier-based | 32,000 |

Requirements

- Immigration Department approval needed (processing time: 2-3 working days)

- Funds must be used specifically for the property purchase.

- Sale and Purchase Agreement (SPA) must be submitted.

Eligible Property Types

- Residential only: Condominiums, apartments, or landed homes

- Minimum purchase price: Meets tier requirement

- Title: Freehold or leasehold with at least 30 years remaining

- Not eligible: Commercial units, shophouses, or certain serviced apartments

Important note: 10-year restriction on resale (upgrade to higher-value property permitted)

Moore Bzi provides end-to-end support for MM2H applications and property purchase, including document preparation, bank and FD setup, and property guidance:

Latest Posts

Simplify Foreign Hiring with Trusted Work Visa Guides:

Get personalised guidance from Moore-Bzi, trusted professionals in Malaysian work permits, visas, and business compliance.

Step-by-Step MM2H Application Process

This consolidated timeline shows all major milestones from pre-application through property purchase completion.

Phase 1: Pre-Application & Document Preparation (Months 1-2)

Financial Preparation

- Verify tier-specific fixed deposit (FD) amounts (funds must be liquid and transferable)

- Check USD/RM currency conversion rates

- Gather 3 consecutive months of bank statements

Essential Documents

Original hard copy certified documents, except for passport are required

- Valid passport (minimum 18 months validity)

- Police clearance certificate (must be issued within 3 months of submission; allow 4 to 6 weeks processing)

- Employment or pension documentation

- Marriage and birth certificates (if including dependents)

- 1 passport photo per person (blue background, 3.5cm × 5.0cm)

Medical Requirements

- General checkup, chest X-ray, HIV & Hepatitis B screening, full blood panel

- Report must be in English, and not older than 3 months

Phase 2: Application Submission & MOTAC Review (Months 2-4)

Week 1-2: Document Compilation

Your MM2H agent prepares and submits:

- Cover letter explaining MM2H intent

- Resume or CV (2 to 3 pages in professional format)

- Personal bond (signed by agent’s authorised director)

- Intention letter for property purchase

- All supporting documents with proper certifications

You will receive Acknowledgement of Payment (AP) within 3 to 7 days upon document submission .

Months 2-4: MOTAC Processing (60 working days)

MOTAC reviews:

- Document completeness

- Financial stability assessment

- Background checks (Immigration & Interpol databases)

- Medical report review

Possible Outcomes:

- Approval → Conditional Approval Letter (CAL) issued

- Additional information request → respond within 7 to 14 days

- Interview (rare, usually through video call)

- Rejection → specific reasons provided; can appeal or reapply

Common Delay Triggers:

- Incomplete or improperly certified documents

- Inconsistent financial documentation

- Expired police clearance or medical reports

- Holiday periods

Phase 3: Conditional Approval & Entry Preparation (Month 4-5)

Upon CAL Receipt (Valid 6 Months):

Review your CAL for:

- List of approved dependents

- Specific endorsement requirements

- Fixed deposit confirmation amount

Major Deadlines Start:

- 6 months to enter Malaysia for visa endorsement (from CAL date)

- 12 months to complete property purchase (from future endorsement date)

Immediate Payments (within 7 days):

- Outstanding agent service fees

- Government participation fees (tier-dependent)

- Journey Performed (JP) Visa fee (RM500/person if entering on tourist visa, depending on nationality.)

What You Can Now Do:

- Enter Malaysia for endorsement

- Open a Malaysian bank account

- Apply for property financing

- Begin serious property hunting

Phase 4: Malaysia Entry & Visa Endorsement (Months 5-6)

Required Documents to Bring:

- Original passport

- Original Conditional Approval Letter

- All original certificates (marriage, birth, medical)

- Proof of funds for FD transfer

- Medical examination at a certified facility (valid 3 months)

Minimum Stay: 3 to 4 business days (longer if property hunting)

Endorsement Process Checklist

| Day | Task | Details |

| 1-2 | Medical Form | Immigration-approved clinic; same tests as home country |

| 2-3 | Bank Account Opening | MM2H-approved bank (Maybank, CIMB, Public Bank, RHB, Hong Leong,etc). Bank requirements: Passport, Conditional Approval Letter (CAL), proof of addressHome bank reference letter |

| Fixed Deposit (FD) Transfer | International transfer (3 to 5 days to clear), convert to FD account | |

| 3-4 | Medical Insurance | No hard limit on minimum coverage (if under 60 years) |

| 4-5 | Immigration Submission | Agent submits all documents to Immigration Putrajaya/state offices |

| 7-12 | Visa Sticker Collection | MM2H visa endorsed in passport; 12-month property countdown begins |

Phase 5: Property Purchase Execution (Months 7-12)

| Timeline | Action Items | Notes |

| Months 7-8 | Active property search & selection | Verify title eligibility; ensure minimum price meets tier requirement |

| Months 9-10 | Execute SPA & FD withdrawal | Apply for FD withdrawal approval 2 to 4 weeks before SPA signing |

| Months 10-11 | Complete transaction | Finalise payment, registration |

| Months 11-12 | Immigration compliance | Submit proof: 2 certified SPA copies, deposit proof, loan letter (if applicable) Best practice: Submit documentation by Month 11 to allow a buffer for corrections. |

Common Failure Points to Avoid

- Delaying the property search until the last months.

- Purchasing ineligible properties without proper title verification.

- Poor timing of FD withdrawal causing financing gaps.

- Using separate visa and property agents leads to coordination issues.

Want to avoid common MM2H application pitfalls? See how experienced guidance can help you navigate these challenges.

Essential Documents by Family Situations

Document preparation is a common source of delays in MM2H applications, with requirements varying on a case-by-case basis. This checklist outlines the essential documents for each applicant type, so you can submit complete, accurate paperwork the first time.

Base Requirements (All Applicants)

This checklist outlines the essential documents for each applicant type, so you can submit complete, accurate paperwork the first time.

- Every Adult (Principal + Spouse):

- Valid passport (Minimum 18 months validity) – certified copy

- 1 passport photo (3.5cm × 5.0cm, blue background)

- Marriage certificate – certified, English translation

- Police clearance (issued within 3 months)

- Medical examination report

- Resume/CV (principal applicant only)

- Principal Applicant Only:

- 3 months consecutive bank statements (official stamped)

- Proof of offshore income (employment letter OR pension statement)

- Fixed deposit proof of funds

- Cover letter explaining MM2H intent

- Medical insurance policy (if under 60 years old, minimum RM80,000)

- Children Under 21:

- Valid passport

- Passport photos

- Birth certificate showing both parents

- Police clearance (if over 18)

- Medical examination

- School enrollment letter (if applicable)

Additional Documentation for Special Situations

If your family unit includes divorced, single-parent, stepchildren, or elderly dependents, additional documents are required. Missing them can lead to rejection.

1. Divorced Applicants with Children

- Divorce decree (certified copy)

- Custody order explicitly showing:

- Sole custody granted to the applicant, or

- Joint custody with international relocation permission

- Notarised consent letter from ex-spouse (highly recommended)

If the ex-spouse is unreachable:

- Court affidavit of abandonment, or

- Legal documentation proving sole decision-making authority

2. Unmarried Single Parent

- Child’s birth certificate listing you as the parent

- Death certificate (certified) if the other parent is deceased

- Statutory declaration if the other parent is uninvolved

- Notarised consent letter if the other parent is reachable

3. Including Parents (Age 60 years and above)

- Your birth certificate showing parent-child relationship

- Parents’ passports and photos

- Parents’ medical examination

- Proof of financial dependency (bank statements showing your support)

The principal applicant’s parents are eligible to be included in the MM2H application. In-laws are considered only if the spouse is included as an MM2H dependent.

Document Certification Requirements

| Document Origin | Certification Method |

| Foreign documents | Embassy or Notary Public |

| Hague Convention countries | Apostille accepted |

| Malaysian documents | Commissioner for Oaths |

How to Vet Your MM2H Agent (Avoid Scams)

Under the latest MM2H regulations, all applications must be submitted through a licensed MM2H agent approved by the Ministry of Tourism, Arts and Culture (MOTAC). Self-direct applications are no longer permitted under the new guidelines.

The Essential MM2H Agent Checklist

Choosing the right agent can make or break your MM2H application. Focus on licensed, experienced, and transparent professionals who can guide you from start to finish.

Quick Must-Do Checks:

- MOTAC License: Verify on the official registry.

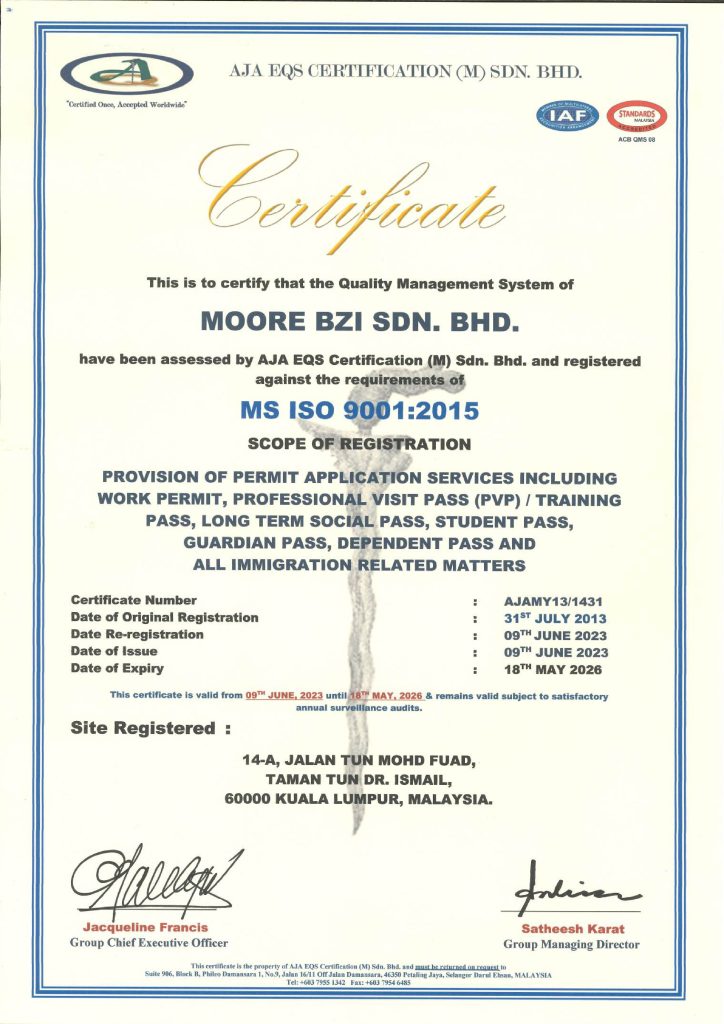

- Office & Certification: Look for a physical office and ISO certification.

- Full Support: Ensure they handle visas, property, banking, and post-approval services.

- Track Record: Ask for recent approvals and client references.

- Transparent Fees: Insist on itemised costs—no lump sums without breakdowns.

Why a One‑Stop Agent Like Moore Bzi Matters

A strong MM2H agent does more than submit paperwork—they coordinate every step of your relocation. Established in 2003, Moore Bzi is fully licensed by MOTAC and ISO 9001 certified, with over 23 years of experience guiding expatriates, investors, and retirees.

Their integrated services: visa processing, property guidance, banking, document certification, and post-approval support—help you avoid common pitfalls:

- Timeline Misalignment: Property search and purchase deadlines align with visa milestones.

- Title Eligibility Issues: MM2H-approved property guidance ensures immigration compliance.

- FD Withdrawal Delays: Fixed deposit timing is coordinated with SPA signing and visa endorsement.

Additional services such as medical checks, insurance, and local banking setup ensure a smooth, fully compliant relocation without juggling multiple providers.

Have questions about MM2H requirements? Check our detailed FAQ for quick, clear answers.

Plan, Apply, and Move with MooreBzi

The 2026 MM2H tiered system offers clear benefits, including long-term residency, tax-free remittance of foreign income, and flexible visa tenure. The real challenge lies in managing the paperwork, coordinating property purchases, and aligning deadlines across multiple agencies.

With over 2 decades of experience, MooreBzi ensures every step from fixed deposit management to property selection, visa endorsement, and post-approval support is seamlessly coordinated. Our integrated approach minimizes risk, avoids delays, and helps you secure your MM2H approval efficiently.

Don’t navigate these complex rules alone. Book a free eligibility consultation with MooreBzi today and map out your personalized MM2H strategy so you can move to Malaysia with confidence.

FAQ

Can I apply for MM2H if I already own property in Malaysia?

Yes. Owning property does not prevent application, but the property must meet tier requirements if using it to satisfy the mandatory purchase rule. Existing properties cannot count toward the minimum purchase for new tier compliance unless approved by Immigration.

Are MM2H visa extensions automatic after the initial period?

No. Extensions must be applied for before the visa expires, and applicants must remain compliant with all MM2H conditions, including FD maintenance, insurance coverage, and property ownership.

Can I include adult children over 21 as dependents?

Only if they are financially dependent and unmarried. Proof of dependency is required, such as bank statements or legal documentation, and Immigration evaluates each case individually.

What happens if my property purchase or FD withdrawal is delayed?

Delays can result in visa downgrade or cancellation. Immigration requires proof of property purchase and FD compliance within the deadlines. Applicants should plan withdrawals and SPA execution early to avoid risks.

Can I use existing health insurance for MM2H purposes?

Only insurance that meets Immigration’s minimum coverage and policy duration requirements is accepted. Existing policies may be used if they provide RM80,000 coverage (for applicants under 60) and cover the entire MM2H visa period; otherwise, a new compliant policy must be purchased.

Freepik

Freepik

Freepik

Freepik